Causes of the Crisis: Too Much Money Chasing Too Few Investments

The prosperity of the Roaring Nineties had two main bases, a solid foundation of productivity growth stemming from information technology, and a more dubious foundation of easy credit and financial innovation. The good times came to an end the old-fashioned way -- with the bursting of a bubble in the stock market. Zandi describes the bursting mostly of a tech bubble while Krugman describes a broader bubble in the stock market as a whole. Both agree that something went seriously wrong with the economy once the bubble burst, but neither seriously explores what.

The decline following the bursting of the bubble was shallow, with unemployment only rising to about 6.5 percent.* But recovery was painfully slow, especially on the employment front, even though Alan Greenspan cut the interest rate the Fed charged banks all the way to 1%, well below the inflation rate of 2.5%, and the Bush Administration gave a Keynesian stimulus in the form of a huge tax cut. Greenspan feared a Japanese style lost decade and, as the recession pushed down already low inflation rates, began to worry about deflation.

So what was the problem? The 9-11 attacks certainly didn't help, but there must have been something more than that. As a mere Enlightened Layperson, I can only offer a few guesses. One is that the '90's productivity growth resulting from adopting new information technologies had reached its natural limits and was not going to keep on giving. Another (much discussed these days) is that recovery following a financial crisis always tends to be slow and painful. As in the 1920's, stock market speculators had been buying on the margins and running up a lot of debt. The 90% margins of the 1920's were no longer allowed. Margins were 50%, but borrowing even half of what you invest can lead to ruinous debt when the underlying stocks end up as so much designer toilet paper. Dot-coms and other tech companies had run up large debts of their own, which ended up as worthless after they failed. Another possible explanation is that the stock market crash had scared investors away from financing anything new and dynamic.

When the economy did move into expansion, an abundance of indicators suggested that this was a far less healthy growth than what had prevailed in the '90's, most likely because it was based on housing. So what's wrong with housing? Economists classify housing as a form of investment, but it is more accurately described as somewhere between consumption and investment. Housing is investment in the sense that it involves long term loans several times larger than the initial down payment. But it is consumption in the sense that a house is a consumer product that does nothing to increase the economy's productive capacity or productivity. Or, put differently, housing is investment in the sense of the financial resources it ties up, but not in the sense of promoting future growth. Given the choice of what to base an economic expansion on, housing would be about last on the list. But central bankers don't get to choose what part of the economy takes off, so Greenspan kept interest rates low in hopes of getting something going, and that something turned out to be housing.

Greenspan is often blamed for the current economic disaster for keeping interest rates too low for too long. Still, one would normally expect too-low interest rates to set off either inflation or an ordinary bubble of the sort we have experienced many times in the past without a comparable disaster. Something else must have gone wrong as well. So far as I can tell, two things went wrong. One was a classic case of investment-level inflation; too much money chasing too few productive investments. The other was changes in how the finance system handled all that money.

Too much money had several origins. Remember those disturbing trade deficits that plagued Mexico and Thailand before their financial crises? Remember how they were financed by foreign investment, investment reaching 6%, 7%, even 8% of GDP? Investment that outran productive outlets, set off a speculative boom, and ultimately proved unsustainable and stampeded out as fast as it stampeded in? Well, the same thing started happening to the US as well. **

Trade deficits, running at a very manageable 1.5% of GDP in 1996 and only slightly higher in 1997, began rapidly escalating afterward, peaking at 6% of GDP in 2006. These deficits appear to have begun escalating about the time of the 1997 Asian financial crisis. These may have been either trade-driven (the Asian downturn hurt ourt exports) or investment-driven (capital flight from Asia to the safety of the US). Some people believe the influx of foreign investment contributed to the stock bubble that burst in 2000. It certainly contributed to the housing bubble.

Trade deficits, running at a very manageable 1.5% of GDP in 1996 and only slightly higher in 1997, began rapidly escalating afterward, peaking at 6% of GDP in 2006. These deficits appear to have begun escalating about the time of the 1997 Asian financial crisis. These may have been either trade-driven (the Asian downturn hurt ourt exports) or investment-driven (capital flight from Asia to the safety of the US). Some people believe the influx of foreign investment contributed to the stock bubble that burst in 2000. It certainly contributed to the housing bubble.

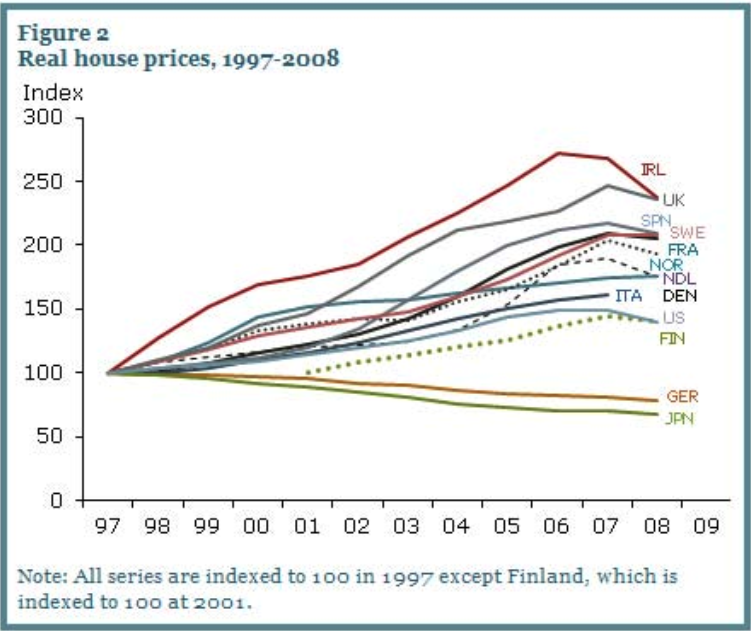

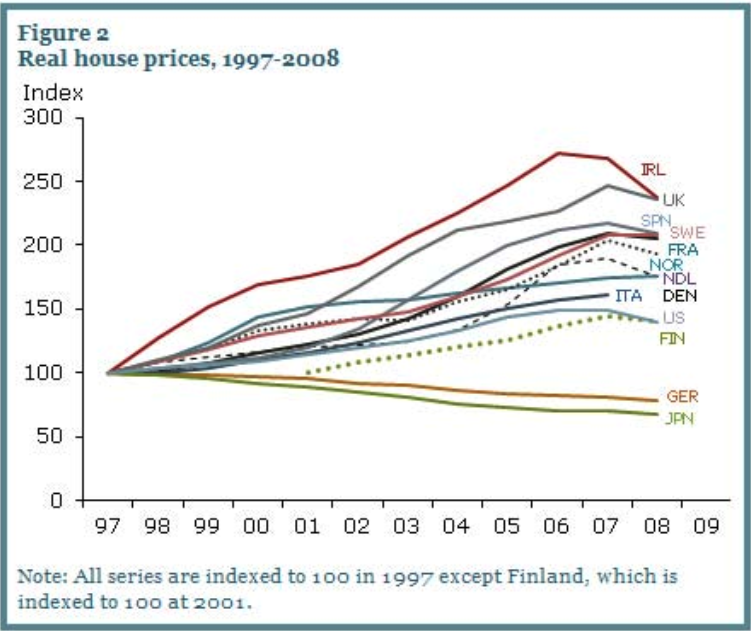

But at the same time, the housing bubble was international. Many countries besides the US experienced a similar surge in housing prices, followed by a downturn, often even worse than ours.

Several things appear to have been happening at once. For one, Alan Greenspan was not the only central banker leaving interest rates low; the tendency was world-wide. For another, international savings had become more mobile than ever before. And critically, there was what Ben Bernanke called a "global savings glut;" a "vast pool of money" that grew from from $36 trillion to $70 between 2000 and 2008. The source of this appears to be partly recycles petrodollars, but mostly an immense growth in wealth in China, which also has a tremendously high savings rate.

China's extraordinary savings rate led to the same paradox that played so large a role in causing Japan's "lost decade" -- too much savings can lead to the buildup of too much debt. This is because the influx of too much investment tends both to bid up prices of assets and to bid down returns. This leaves the finance system in general in the same place the hedge funds were in at the time of the LTCM crisis, desparately taking more and more risks with more and more borrowed money to feed the insatiable appetites of investors. Rising asset prices and falling returns also strongly encourage speculation over productive, long-term investment.

Next: Internal problems in the finance system.

_________________________________

*It should go without saying that if unemployment gave any sign of falling even close to 6.5% today, there would be dancing in the streets.

**Krugman discusses the dangers of such large trade deficits, but does not address what size of deficit would be safe. He does comment that Australia has been running trade deficits of 4% of GDP "for decades," all funded by foreign capital. So perhaps the danger is not in the specific size of the deficit, but in rapidly rising deficits, which we certainly had.

The decline following the bursting of the bubble was shallow, with unemployment only rising to about 6.5 percent.* But recovery was painfully slow, especially on the employment front, even though Alan Greenspan cut the interest rate the Fed charged banks all the way to 1%, well below the inflation rate of 2.5%, and the Bush Administration gave a Keynesian stimulus in the form of a huge tax cut. Greenspan feared a Japanese style lost decade and, as the recession pushed down already low inflation rates, began to worry about deflation.

So what was the problem? The 9-11 attacks certainly didn't help, but there must have been something more than that. As a mere Enlightened Layperson, I can only offer a few guesses. One is that the '90's productivity growth resulting from adopting new information technologies had reached its natural limits and was not going to keep on giving. Another (much discussed these days) is that recovery following a financial crisis always tends to be slow and painful. As in the 1920's, stock market speculators had been buying on the margins and running up a lot of debt. The 90% margins of the 1920's were no longer allowed. Margins were 50%, but borrowing even half of what you invest can lead to ruinous debt when the underlying stocks end up as so much designer toilet paper. Dot-coms and other tech companies had run up large debts of their own, which ended up as worthless after they failed. Another possible explanation is that the stock market crash had scared investors away from financing anything new and dynamic.

When the economy did move into expansion, an abundance of indicators suggested that this was a far less healthy growth than what had prevailed in the '90's, most likely because it was based on housing. So what's wrong with housing? Economists classify housing as a form of investment, but it is more accurately described as somewhere between consumption and investment. Housing is investment in the sense that it involves long term loans several times larger than the initial down payment. But it is consumption in the sense that a house is a consumer product that does nothing to increase the economy's productive capacity or productivity. Or, put differently, housing is investment in the sense of the financial resources it ties up, but not in the sense of promoting future growth. Given the choice of what to base an economic expansion on, housing would be about last on the list. But central bankers don't get to choose what part of the economy takes off, so Greenspan kept interest rates low in hopes of getting something going, and that something turned out to be housing.

Greenspan is often blamed for the current economic disaster for keeping interest rates too low for too long. Still, one would normally expect too-low interest rates to set off either inflation or an ordinary bubble of the sort we have experienced many times in the past without a comparable disaster. Something else must have gone wrong as well. So far as I can tell, two things went wrong. One was a classic case of investment-level inflation; too much money chasing too few productive investments. The other was changes in how the finance system handled all that money.

Too much money had several origins. Remember those disturbing trade deficits that plagued Mexico and Thailand before their financial crises? Remember how they were financed by foreign investment, investment reaching 6%, 7%, even 8% of GDP? Investment that outran productive outlets, set off a speculative boom, and ultimately proved unsustainable and stampeded out as fast as it stampeded in? Well, the same thing started happening to the US as well. **

Trade deficits, running at a very manageable 1.5% of GDP in 1996 and only slightly higher in 1997, began rapidly escalating afterward, peaking at 6% of GDP in 2006. These deficits appear to have begun escalating about the time of the 1997 Asian financial crisis. These may have been either trade-driven (the Asian downturn hurt ourt exports) or investment-driven (capital flight from Asia to the safety of the US). Some people believe the influx of foreign investment contributed to the stock bubble that burst in 2000. It certainly contributed to the housing bubble.

Trade deficits, running at a very manageable 1.5% of GDP in 1996 and only slightly higher in 1997, began rapidly escalating afterward, peaking at 6% of GDP in 2006. These deficits appear to have begun escalating about the time of the 1997 Asian financial crisis. These may have been either trade-driven (the Asian downturn hurt ourt exports) or investment-driven (capital flight from Asia to the safety of the US). Some people believe the influx of foreign investment contributed to the stock bubble that burst in 2000. It certainly contributed to the housing bubble.But at the same time, the housing bubble was international. Many countries besides the US experienced a similar surge in housing prices, followed by a downturn, often even worse than ours.

Several things appear to have been happening at once. For one, Alan Greenspan was not the only central banker leaving interest rates low; the tendency was world-wide. For another, international savings had become more mobile than ever before. And critically, there was what Ben Bernanke called a "global savings glut;" a "vast pool of money" that grew from from $36 trillion to $70 between 2000 and 2008. The source of this appears to be partly recycles petrodollars, but mostly an immense growth in wealth in China, which also has a tremendously high savings rate.

China's extraordinary savings rate led to the same paradox that played so large a role in causing Japan's "lost decade" -- too much savings can lead to the buildup of too much debt. This is because the influx of too much investment tends both to bid up prices of assets and to bid down returns. This leaves the finance system in general in the same place the hedge funds were in at the time of the LTCM crisis, desparately taking more and more risks with more and more borrowed money to feed the insatiable appetites of investors. Rising asset prices and falling returns also strongly encourage speculation over productive, long-term investment.

Next: Internal problems in the finance system.

_________________________________

*It should go without saying that if unemployment gave any sign of falling even close to 6.5% today, there would be dancing in the streets.

**Krugman discusses the dangers of such large trade deficits, but does not address what size of deficit would be safe. He does comment that Australia has been running trade deficits of 4% of GDP "for decades," all funded by foreign capital. So perhaps the danger is not in the specific size of the deficit, but in rapidly rising deficits, which we certainly had.

Labels: Economy

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home